Established in 1994, VCT Vector Gestion SA is an independant Swiss wealth management

company providing customized solutions to an international and local clientele.

We uphold the values of respect, high standards and integrity. Our approach is based on the quality of the service we provide to our clients, expertise in financial management and total investment independence

You are unique,

Your situation is unique,

Your environment is unique,

Vector Gestion provides you with a tailor-made response.

Vector Gestion focuses on the person and not just on their wealth.

We seek to understand your overall situation in order to master your specificities as best we can.

We are fundamentally independent.

The shares are owned by the senior managers. The Board of Directors is made up of a majority of independent members. Vector Gestion’s is totally independent of custodian banks and other partners.

At Vector Gestion: “We say what we do and we do what we say.”

Decisions and their implementation are carried out in Nyon, Lausanne or Geneva. The line of action is clearly expressed and your investment manager adheres to it. Robotized, standardized management is not our style.

Vector Gestion achieved first place in the IBO 2018 ranking for the management of low-risk portfolios. This award encourages our team to persevere with our strategy of controlling portfolio risks in all market phases.

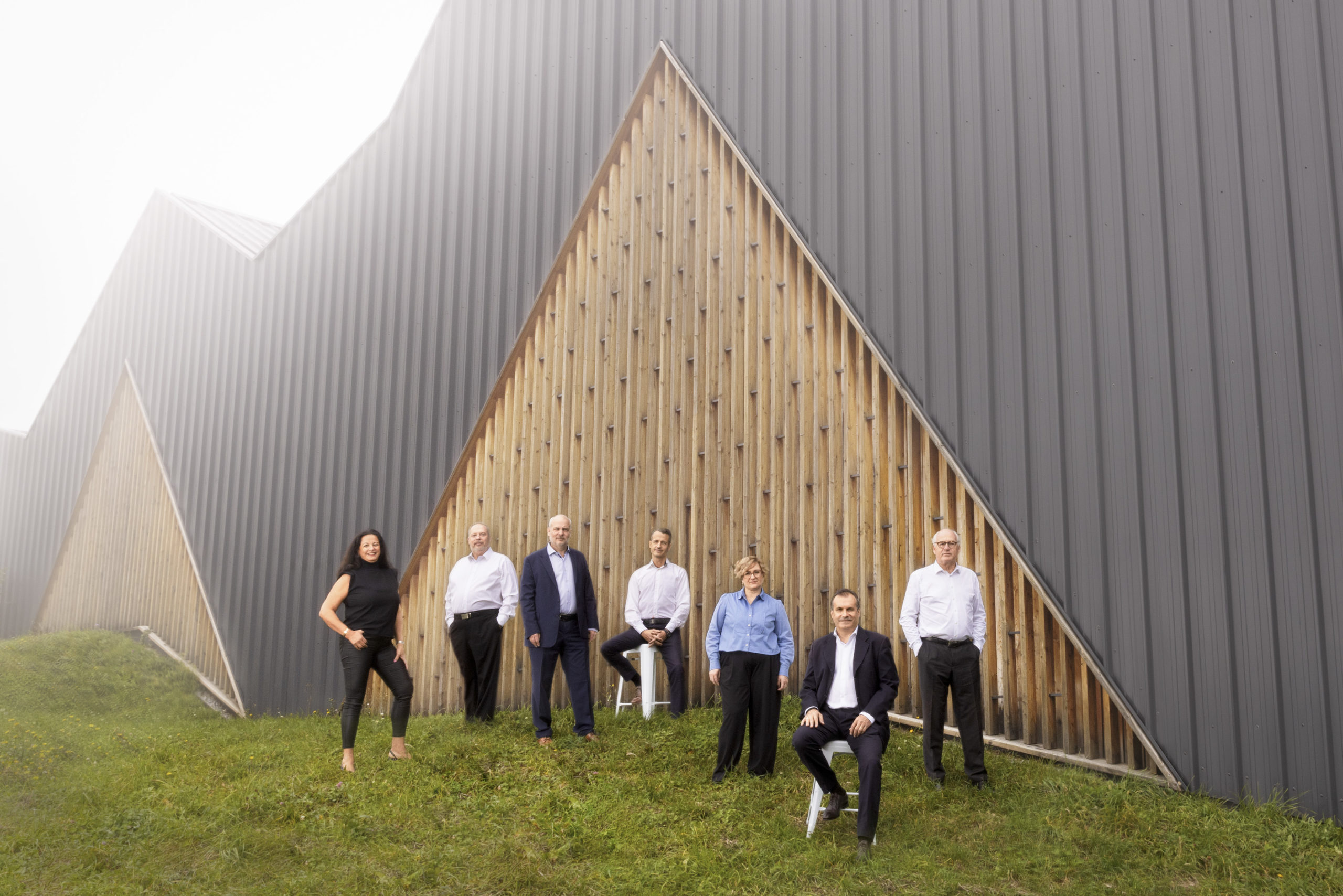

Our team

Based in Nyon, Lausanne, Morges and Geneva, Vector Gestion employs some thirty professionals.

Discover the news of Vector Gestion

En 2025, les marchés financiers ont navigué entre niveaux historiques et incertitudes géopolitiques et économiques

La rédaction de la revue trimestrielle de fin d’année peut parfois procurer un sentiment de soulagement ; une année tumultueuse arrive à son terme et nous sommes parvenus à générer de bons résultats pour nos clients en dépit des multiples rebondissements et des...

Buy low, sell high. La clé d’une stratégie de placement réussie

Nous, gérants de fortune — et plus encore les analystes — avons une passion : scruter les chiffres, suivre l’actualité, rédiger des prévisions aussitôt dépassées. Fascinés, nous observons chaque mouvement des marchés et cherchons à comprendre pourquoi, et pourquoi...

La fin de l’ESG

« Comme la plupart des investisseurs le savent, ESG signifie environnement, social et gouvernance – un cadre d’analyse permettant d’évaluer la manière dont les entreprises gèrent la durabilité, l’éthique et les risques à long terme. »